Blogs

Worker Misclassification: The Hidden Risks of Per Diem Staffing

As changes continue to reshape healthcare and education sectors, staffing flexibility is crucial. As a result, many organizations may feel the need to turn to per diem staffing as a cost-effective solution that offers them the flexibility needed to get through staffing uncertainty. While this approach may be beneficial in the short term, it can hide significant risks that might not be apparent until it’s too late.

The Growing Issue of Worker Misclassification

Recent headlines have highlighted a disturbing trend in the staffing industry. A landmark case resulted in staffing firms being required to pay $2.4 million in settlements due to worker misclassification and nonpayment of overtime. While this case may seem like an isolated incident, it represents a growing pattern of organizations facing consequences for improper worker classification.

Understanding the Real Costs

While per diem staffing can be a smart way to reduce costs at times, there are some potential risks that could outweigh the initial savings:

Regulatory Penalties

Misclassifying workers can result in substantial fines from state and federal agencies

Legal Expenses

As recent cases show, class-action lawsuits from misclassified workers can lead to multi-million-dollar settlements

Back Pay Requirements

Organizations found to have misclassified workers may be required to pay back wages, overtime, and benefits

Reputation Damage

Public legal battles over worker classification can severely impact an organization’s ability to attract both clients and talent

The W2 Alternative:

Protection Through Proper Classification

Working with a W2 staffing company might come with higher upfront costs, but it provides crucial protections and benefits:

Clear Employment Status

Workers are properly classified

from day one

Comprehensive Coverage

Workers’ compensation, unemployment insurance, and other essential benefits

are properly handled

Risk Mitigation

The staffing company assumes responsibility for proper classification

and compliance

Make Informed Staffing Decisions

Understanding the distinction between per diem and W2 staffing can be crucial for making sound business decisions. While the initial costs might seem higher with W2 staffing, the long-term protection and peace of mind may prove to be invaluable.

Check out our comprehensive guide, Creating an Optimized Staffing Strategy, to learn insights into:

- Comparing costs between per diem and W2 staffing

- Understanding the risks of per diem staffing

- Selecting the optimal staffing strategy for your needs

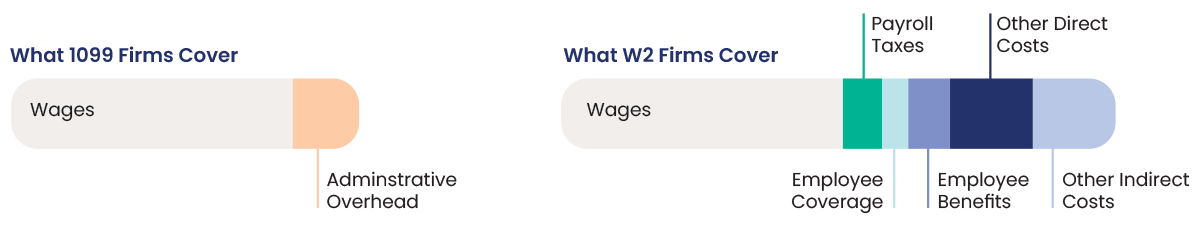

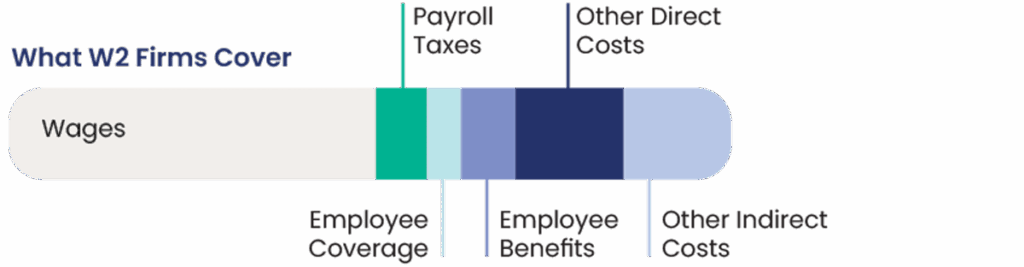

Reasons for Potential Cost Differences

Which Approach is Right for Me?

These graphics are for illustrative purposes only and represents typical coverage by each type of firm. Actual cost breakdowns may vary depending on individual circumstances.

Terms to Know

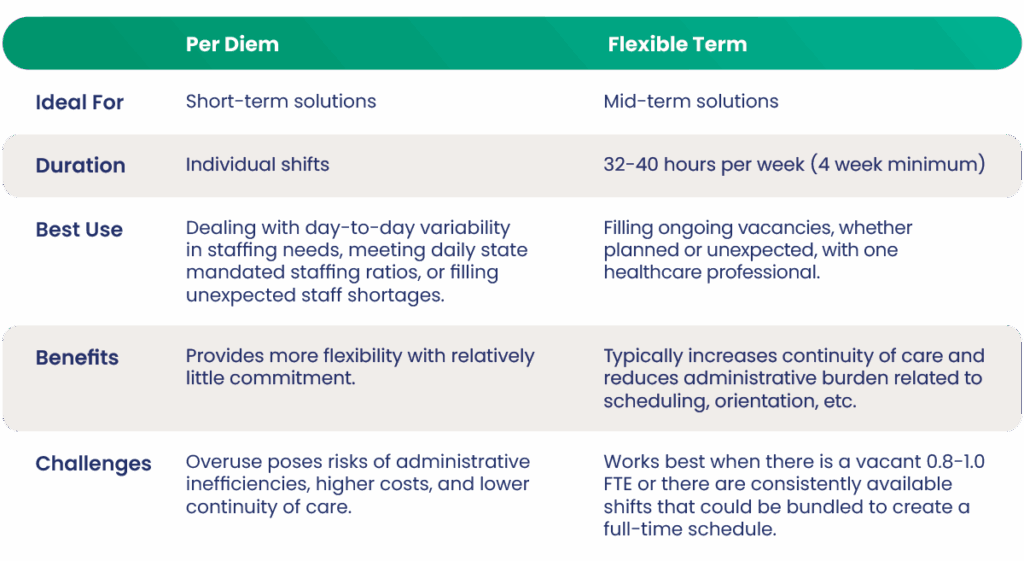

- Per Diem: Originating from the Latin phrase meaning “by the day,” this staffing model involves using temporary professionals to fill individual shifts as needed. Synonyms: PRN, Registry, Shift work

- Flexible Term: A staffing model that provides quick access to qualified professionals for specific projects or planned/extended absences without requiring long-term commitments. Synonyms: Temp staffing, Contract, Interim, Project-based, Extended assignment

- W2 Employees: Workers hired to perform services under an employer’s control and direction, with the employer dictating how, when, and where work is done. The employer withholds taxes and typically provides benefits like health insurance and paid time off, while providing a W2 tax form annually.

- 1099 Contractors: Self-employed individuals who provides services under specified contract terms, with control over how, when, and where they complete their work. They are responsible for their own taxes including self-employment tax, typically don’t receive employee benefits, and are often hired for specific projects.

- FTE (Full-Time Equivalent): A unit that indicates the workload of an employed person in a way that makes workloads comparable across various contexts.

- Mandated Overtime: When an employer requires an employee to work more than their regularly scheduled hours, often due to staffing shortages.

- Mandated Staffing Ratio: The legally required minimum proportion of healthcare staff to patients, established by regulatory bodies to ensure patient safety and optimal working conditions.

- Employee Misclassification: Incorrectly classifying workers as independent contractors instead of employees, which can lead to legal and financial consequences.

- Other Direct Costs: Those for activities or services that benefit specific projects or clients (i.e. Salaries of sales teams, recruitment, credentialing, and recruitment resources, etc.).

- Other Indirect Costs: Those for activities or services that benefit more than one project or client (i.e. HQ advertising, Legal, Payroll, A/P, HR, and compliance).

Ready to learn more about protecting your organization from misclassification risks?

Get the latest blogs, news and company updates

Want to get the latest staffing related news and updates? Subscribe to our resources to get insights sent straight to your inbox.